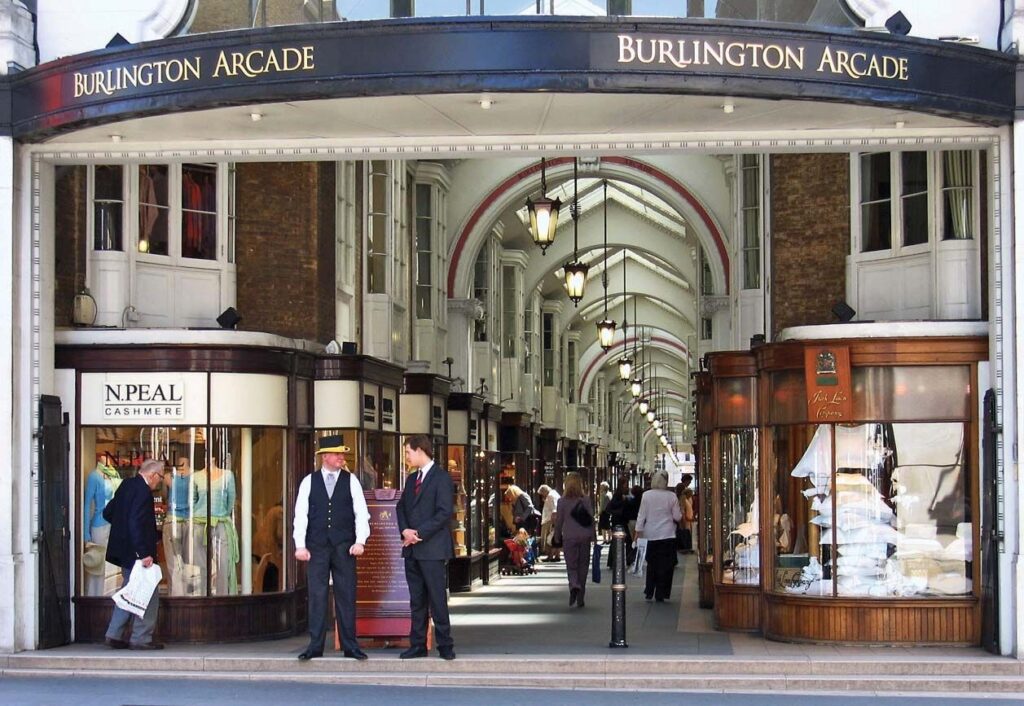

Mayfair Mortgage Broker

Property Finance Choices

Let us help you obtain the necessary funds at the most advantageous rates and with swift approval for your property investment, loan refinancing, or business financial needs.

CALL NOW

020 3758 9393

EMAIL NOW

sales@propertyfinancechoices.com

Get a Callback

Simply fill in the form above.

About Mayfair Mortgage Broker- Property Finance Choices

Welcome to Property Finance Choices, your trusted mortgage broker, here to assist you in making informed decisions for your property financing needs. Whether you are a first-time homebuyer, looking to remortgage, or seeking investment opportunities, we are dedicated to providing personalised solutions tailored to your unique financial circumstances.

At Property Finance Choices, we understand that navigating the complex world of mortgages can be overwhelming and time-consuming. Our team of experienced and qualified mortgage advisors is here to simplify the process for you. We take the stress out of finding the right mortgage by offering expert guidance and a wide range of services to suit your requirements.

Our commitment to transparency and customer satisfaction sets us apart. As independent mortgage brokers, we work with a diverse panel of lenders, ensuring you have access to a comprehensive selection of mortgage products, including fixed-rate, variable-rate, and specialised mortgages. With our assistance, you can compare rates, terms, and features to secure the most competitive and suitable deal for your needs.

Specialist Local Mortgage Broker

A Decision in Principle (DIP), also known as an Agreement in Principle (AIP) or Mortgage in Principle (MIP), is a document or statement provided by a mortgage lender that indicates how much they are willing to lend you based on an initial assessment of your financial situation. While it is not a guarantee that you will be approved for a mortgage, it serves several important purposes and benefits for potential homebuyers:

Get your Free Decision in Principle certificate hereRange of Lenders

Access to a whole range of lenders providing you the most competitive offers.

Dedicated Case Handler

Have just one point of contact to ensure a smooth process.

No hidden costs!

We charge a one time application fee and we sometimes receive commission from a 3rd party lender with full transparency.

Local Expert Guidance

We have been working in this local area for more than 5+ years we understand all the local market trends providing you the best service.

Mortgage Enquiry

Residential Mortgages | HMO | BTL | Refinance | Bridging Finance | Development Finance

Want to start viewing properties?

If you wish to start viewing properties you must first get a Decision in principle this is to show that you can financially afford it. Simply fill in a short 10 minute form below to have a certificate emailed to you.

We are Looking for Introducers.

We are always on the hunt for new people to refer us clients in return we offer a high referral fee which your own ability to track the applications in real time.

The Application Process

Compare and Check

Let us compare the latest mortgage deals for you over the phone, or do it yourself in real-time online using our online application portal.

Apply Online

You won't have to tell us any info twice, we'll keep it and put it in the form so you can check it and apply by phone or online.

Track and Complete

Track your application online 24/7. We'll even appoint a dedicated case manager who'll do all the legwork for you. We will keep you updated every step of the way all the way up until completion.

Voted Mayfair Trusted Mortgage Broker 5 Years in a row!

Our Partners

Established in 1982 and led by Founder and Chairman Peter Wetherell, supported by a senior team of highly experienced professionals, Wetherell is the influential market leader for Mayfair property,

With over 160 years’ experience matching people and property throughout London, we’re not only one of London’s longest established agents, but also one of the most prevalent.

Carter Jonas is a leading UK property consultancy working across commercial, residential, rural, planning, development and infrastructure.

Jackson-Stops’s tailored approach to residential property puts our clients at the centre of all we do. From beginning to end, our knowledge, advice and exceptional service will steer your purchase or sale to successful completion.

We are Harrods Estates, a specialist estate agency with a unique portfolio of properties in super-prime areas of London, including Knightsbridge, Mayfair, Kensington and Chelsea.

Oliver James is a modern boutique agency specialising in the sale, rental, investment and acquisition of luxury real estate in Mayfair and the surrounding areas of Prime Central London.

Frequently Asked Questions

The shortest mortgages have terms of 2-3 years, but these tend to be rare and used in particular scenarios. At the other end of the scale, it is sometimes possible to have 40-year mortgages, but these tend to be offered to mainstream borrowers with good income looking to maximise what they can borrow, rather than the norm for high-net-worth individuals.

For high-net-worth individuals, mortgages with terms of 5 to 25 years are typical, although mortgages in the 5-to-15-year range tend to be the most usual.

An interest-only mortgage is when you effectively pay your lender the interest on the amount you borrowed, but you don’t make repayments on the principal loan amount. At term, this means you have repaid the borrower the interest you owe, but the principal remains outstanding, and you will need to repay it. Interest-only mortgages are relatively rare these days and are generally only offered to high-net-worth individuals who will easily be able to repay the principal amount at term.

Repayment mortgages are the most common type of mortgage today. Here, you will make monthly repayments to your lender, repaying both the capital and interest each month over the loan term.

Generally, yes, provided you can put down a good deposit, afford the mortgage in terms of income, and your income is steady and has been for some time (lenders will generally look at your tax return over the past three years). Self-employed mortgages generally tend to be more challenging to arrange if you approach lenders without the help of a mortgage broker. Lenders view self-employed borrowers as riskier than employed borrowers, especially if you want a mortgage of £500,000 or more. PFC has a track record of helping self-employed individuals to borrow significant amounts, connecting you with lenders that can look at things like directors loans that you will eventually pay yourself back or recent changes to your business that have dramatically increased your income.

Mayfair Mortgage Broker - Our Services

Property Finance Choices are professional mortgage brokers founded in 2022 with more than 25+ years experience across the team.

We have access to all lenders including high street banks, multinational private banks, specialist lenders and funds, private offices and high net-worth investors.

Our Core Services Are:

– Buy to Let Mortgages (for single properties, portfolios and multi-unit blocks)

– Bridging Finance (1st and 2nd charge for residential or commercial properties)

– Development Finance (for high-value single units, multi-unit blocks, commercial property including offices, hotels, retail, student accommodation and PRS)

– Developer Exit Loans (to refinance recently completed development schemes)

– Commercial Mortgages (offices, retail, hotels, restaurants, for investment or owner occupation)

– Borrowers can be personal names or Ltd company / corporate structures and UK or overseas nationals

– Our core business is in London, but we cover all of the UK and also arrange finance for European real estate

– Remortgaging finance to match your needs and achieve a better rate

– Working with HNW Individuals and Companies to acquire and source exclusive funding

We also provide advice around all forms of insurance to pay out in the event of an accident, illness, injury or death to make sure you and your family are protected against whatever life throws your way.

Blogs

Mortgages for Properties with Commercial Potential

When discussing mortgages for properties with commercial potential, you’re looking at a unique sector of the mortgage market. This category includes properties that either have a mix of residential and commercial uses or properties that could be converted from residential to commercial use. Here’s a comprehensive overview for a blog

The Impact of Demographic Trends on Mortgage Demand

Demographic trends play a significant role in shaping the demand for mortgages, influencing the housing market and broader economic conditions. Below is a detailed overview that you could use for a blog post on this topic, focusing particularly on the UK: The Impact of Demographic Trends on Mortgage Demand in

Mortgages for Properties with Co-Buyers

When buying a property with a co-buyer, whether it’s a partner, family member, or friend, there are specific mortgage considerations that come into play. Here’s a detailed guide to help navigate the process: 1. Understanding Joint Mortgages 2. Types of Co-Buyers 3. Ownership Structures 4. Affordability Assessment 5. Legal Considerations